Bags full, trucks humming, the port ahead lit even before sunrise. The atmosphere buzzes, then rain settles in with arrogance, and all optimism evaporates. Roads transform, water everywhere, memories of last year’s hold-ups return, but this, this disrupts on another scale. Goods forgotten on docks, vegetables rotting, clients phoning non-stop, deadlines crumbling. Reliability abandoned you, again, by a monsoon.

No process dodges this chaos. Each flood leaves its mark, transforming proven links into riddles. Now, the world craves solutions ahead of the next disaster. Why do these setbacks feel endless, and why do their rules frustrate global commerce with such violence? Planners now factor in the flood risk before signing any contract or map.

This might interest you : Empowering student achievement: creative strategies for uk schools to harness edtech for enhanced learning results

The flood impact on supply chain logistics in 2026

Disorder in the supply chain slips in fast, almost unexpectedly. The rain never consults logistics teams—just barrels across continents, ignoring schedules, disrupting entire sectors.

the context of flood risks in modern supply chain flows

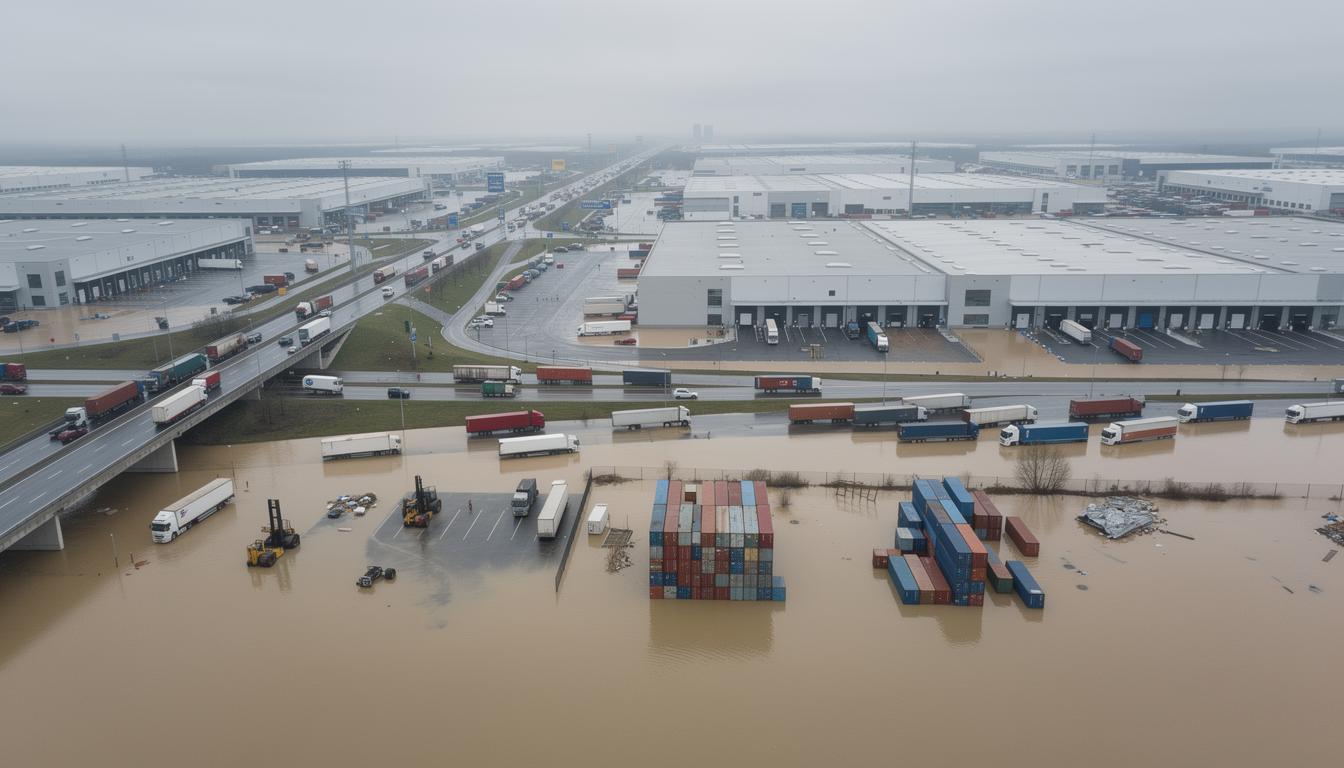

Every continent faces its flood season, ignoring borders. In 2026, few planners napped through the alarms. Ports in Vietnam and Thailand barely functioned, cargo yards blending into rising rivers. Old stories, yes, but new every year. In central Europe, trucks rerouted around swollen Elbe and Danube, kilometers lost, time dragging.

Also to discover : Elevating customer loyalty: creative gamification techniques for retail success in the uk

How prepared did any tool leave them? Satellites noticed, radars screamed, but water still sliced through every map. Faster, leaner supply models promised abundance, then left supermarket shelves bare. One rainstorm upstream, supermarket stock collapses. Factories idle, someone waits for a component nobody can buy. **Suddenly, global flows look frail and exposed, not agile at all.**

Asia’s IT sector lost crucial exports as their regions flooded, America noticed—delivery dates now a distant promise. In Germany, auto parts traveled detours stretching weeks. Those with fingers on the supply chain pulse suddenly found routine an illusion. Replaying old solutions fails. Flooding expects improvisation, sharp reflexes, not autopilot. Those waiting for the next break only find themselves correcting another disaster.

the stages of supply chain logistics affected by floods

No one expects floods to stay in their lane. One delivery blocked? That ripples.

Every link buckles, from procurement to last-mile delivery. The big rig stops at a submerged bridge. Warehouses fill with water, forklifts sit silent, electronics fizz out. Buyers scramble for new sources after Asia fails. Deliveries limp along strange new paths, morale dripping away.

At every checkpoint, the flood exposes different weaknesses. Timetables shatter, overtime balloons. Old plans dissolve into frantic improvisation. Orders to alternative ports stretch resources thin. One extraordinary January, truck deliveries across European corridors slowed by 60 percent. The ledger records the shock:

Supply Chain Step Usual Performance (Pre-flood) Performance During Flood Road Freight Transit Time 48 hours 120 plus hours Port Throughput (TEU per week) 10,000 2,500 Inventory Turnover 5 times per month 1 to 2 times per month Supplier Lead Time 7 days 21 to 28 days

The pattern pulses through every late invoice, every missing product, each empty supermarket bin.

The far-reaching effects of flood disruptions on operations and finance

Storms never announce themselves between quarterly reports. Rain simply falls, inventory vanishes, figures slip deeper into red.

the operational and financial fallout after floods

Stockouts become routine, holding costs explode with emergency air freight. Orders miss critical deadlines, financial penalties compound, insurance rises—without conversation.

The loss floods two places: profit and reputation. Partners, once patient, document each failing. Miss one shipment, lose months of expected earnings. Blow one product launch, lose next year’s contracts and the faith of retailers. In late 2025, a Chinese electronics group missed a vital launch due to flooded Mekong routes. Profits dropped, clients switched brands. The sting went beyond numbers.

Everyone feels these setbacks. Contact with supply managers week after week reveals the flood torments budgets, unsettles even the most seasoned.

the altered terrain of inventory, sourcing, and freight

Snapshot last month: warehouse shelving crammed, staff relieved. One Saturday later, floodwater took it all. Now safety stock dominates, costs balloon, flexibility dissolves.

Just-in-time philosophy collapses under repeated disasters. Manufacturers hold extra stock, sometimes at the expense of cash flow. Sourcing scatters—nobody trusts a single supplier. Transport pivots to air, rail, or whatever route survives. Shopping for the least-flooded passage becomes the norm.

Where five inventory turnovers were standard, now two surprise no one. Working capital sticks, delays turn regular, disappointment hardens. Every missed deadline whispers risk, every quick pivot defines survival. Water never respects planning; it uncovers any weakness in a system built for speed.

- Stockpiling increases, freezing working capital.

- Supplier portfolios diversify—no one bets on a single region.

- Digital tracking and advanced mapping became daily necessities.

- Redundancies in transport emerge, especially in flood-prone corridors.

The new realities of flood impact on supply chain logistics and network adaptation

Strategies mutate as flood shock becomes habit, not exception.

the risk assessment and planning mindsets dominating 2026

Luck lost its meaning. Digital maps layer live weather feeds onto transport arteries, pinpointing warehouses on the brink of closure.

Local alliances with municipalities and safety boards secure green lights for high-alert shipments. Everyone drills rerouting and staged inventory scenarios. The electronics export sector in Vietnam saved itself only with trained teams and real-time data-sharing from regional authorities.

Now, adaptation defines company policy. Resilience happens through innovation, not chance. If a plan stays fixed, a single rainstorm erases it. Improvisation reigns. Those who cling to old templates surrender margins.

the role of infrastructure and tech upgrades

Warehouse floors, once flat, now rise above ancient flood-lines. IoT sensors in containers relay alerts before routes drown, launching backups instantly. Digital twins—no longer just a buzzword—simulate every disaster, seeking the viable alternatives.

Inventory now sits in smarter places, never just the spot with lowest rent. Ports, roads, and bridges targeted by engineers studying Houston’s 2024 devastation stand taller and stronger. SAP, Alibaba, dozens of giants—everyone rewrites code to preempt the next headache.

These improvements drive up costs. But when floods hit, those who built redundancy count fewer shocks. Flexibility and digital smarts replace hope and habit. In 2026, safety comes built with steel, software, and relentless learning.

Take Marina’s story—timing everything, launches made easy, until the big Mekong flood. With her dashboard lit in red, drivers on the phone, clients impatient, she calculated losses equal to an entire year’s hard-won profit. Since then, rainfall means more to her than currency swing. Her warehouse stands drier, upriver, protected with IoT alerts. That shock still rattles, but the new protocols run deeper, tougher.

The escalation of flood risks, climate, and tomorrow’s logistics models

Old rules offered little comfort in 2026.

the weight of climate and urban sprawl on flooding?

Storms break records across meteorological agencies. From Shanghai to Mumbai to Houston, the flood days rack up. Wet seasons last longer, rain falls heavier—WMO reports a 27 percent jump over five years. Aging sewers in bustling cities strain under this stress.

Urban growth ignores old boundaries, warehouses and factories find themselves in danger zones. Mumbai’s car industry adjusted its investment; Houston saw $1.2 billion spoiled in corporate stock, FEMA counted the losses. Climate volatility connects every hub and outpost, amplifying risk while shrinking safe ground. The next hit always seems inevitable; speed of response wins business.

the new strategies for global supply chains

Watch as beliefs fade. Cheaper used to win, now resilience turns heads. Networks hug home markets, inventory moves closer, localized partners step up. Multinationals trust digital twins and real-time dashboards to see what’s next.

Market leaders—Maersk, FedEx, Walmart—draw new arrows on maps, paths encircle, not stretch.

Feature Legacy Model Resilient Model Sourcing Far-flung single-source Diversified regional Visibility Delayed manual Real-time digital twin Inventory Just-in-time Safety stock flexible Transport One preferred mode Multi-modal redundant

Forget old patterns. The logistics world writes new guidelines with every rainstorm. Sobering? Yes. Preventable? Sometimes. The next supply chain model cannot afford yesterday’s blind trust.